Published on: 12/23/2025

This news was posted by Oregon Today News

Description

Eight years after it began, Oregon’s retirement savings program has grown a lot and is showing signs of success. But many of the people using the program are taking money out long before retirement.

Belinda Russell is an accounting specialist at Provoking Hope in McMinnville.

She began saving for her retirement back in 2017, the same year OregonSaves started. The 62-year-old now has $15,000 saved.

“I understand that in these days and times, it’s not a lot of money,” Russell said. “But I’m 100% grateful to this program, because without it, I’d have zero.”

The average retirement savings of a 60-year-old American is close to $250,000 — but that’s only counting people who actually save. Roughly 40% of Americans don’t have any kind of retirement account.

OregonSaves was started to give Oregonians who don’t have a workplace retirement plan a place to save. Oregon was the first state in the nation to introduce such a program. It’s designed to follow people as they move from job to job, and it comes directly out of their paychecks.

“The fact that it comes out before you even see it is huge,” said Russell.

Many people don’t have the financial discipline to set up a retirement account at a big national bank or investment firm, Russell said.

“Because if you have to decide to walk down the street to your local [bank], you’re not going to do it. You’re not going to cash your check and take that money and deposit it there,” she said. “You’re going to cash that check, and you’re going to spend it.”

By many measures, OregonSaves is a success. Some 180,000 Oregonians now have accounts; that’s equivalent to the entire population of Salem. The average enrollee invests about $200 a month and sets aside almost 7% of their income.

It’s been so successful that 19 other states have followed suit and set up their own versions.

But OregonSaves also has a problem: people keep dipping into their savings.

“You go in and you take money out,” said Debra Cross, who also works at Provoking Hope.

Until a few years ago, Cross was saving 8% of her income. But then she needed money.

“I was sick with COVID and my sister passed away,” she said. “So it was between prescriptions and paying for her [funeral] service.”

Of the 180,000 accounts in the OregonSaves system, close to 40% have had withdrawals. A good portion of those withdrawals are from people who have retired. But another sizable portion are from people like Cross who simply needed the money.

The result is that the average account balance at OregonSaves is just $3,000.

“Clearly $3000 is not enough for retirement,” said Oregon Treasurer Elizabeth Steiner. But she says the $3,000 average is a bit misleading. There are many enrollees who have hundreds of thousands of dollars. In addition, 1,700 new people are enrolling in the system every month, starting with nothing in their accounts.

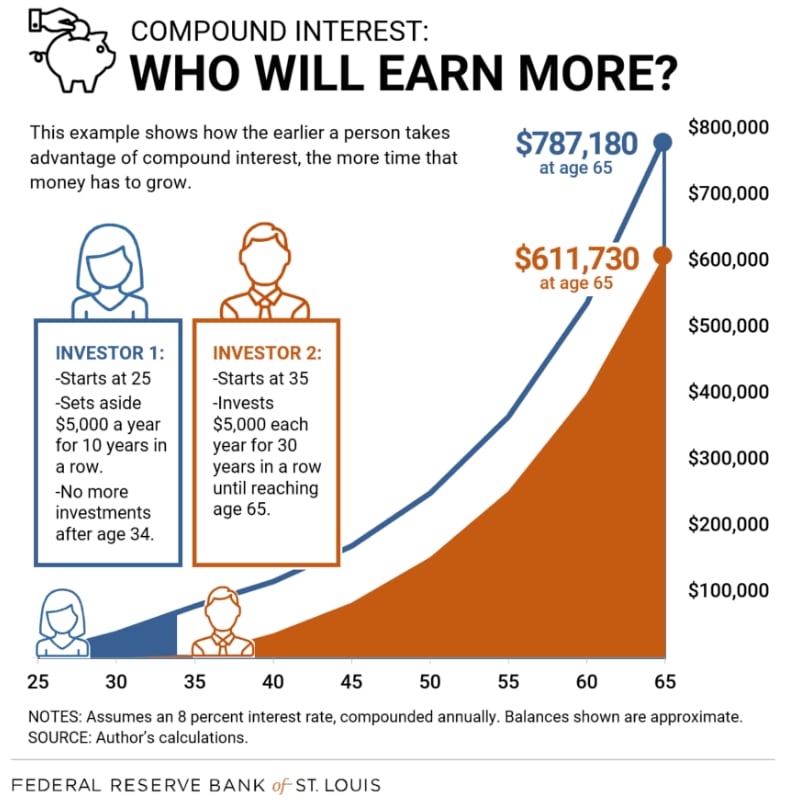

“We’re seeing that a significant percentage of savers are people in the age range of 26 to 30. So if you already have $3,000 in the bank at 30, and you’re really working at saving, then your retirement’s gonna be very different.”

Steiner said there’s also no plan to make it more difficult to get money out of OregonSaves.

“People make these withdrawals, but they don’t clean out their accounts. They take the minimum they need to solve whatever their immediate problem is, and they go right back to saving,” said Steiner.

That’s true for Cross. While she did pull money out of her account, she’s still paying into the system and says OregonSaves gave her an appreciation for the power of compound interest.

“When it first started, I couldn’t believe how much I accumulated,” Cross said.

She still has $1,000 in her account. If she keeps paying in $200 a month and earns a respectable 7% interest, then she’ll have $46,000 when she turns 70.

A third of that, almost $17,000, will have been generated by interest in just 12 years.

“That’s really nice if I don’t touch it and just leave it there and let it draw interest,” she said.

The importance of saving is only growing. The Bipartisan Policy Center expects Social Security to be significantly depleted by 2033. So unless Congress acts, people are likely to see benefits reduced by 23% in just eight years.

And as the end of this year approaches, economists are recommending people fully fund their retirement accounts.

News Source : https://www.opb.org/article/2025/12/23/oregon-saves-oregonsaves-retirement/

Other Related News

12/23/2025

The Powerball jackpot has jumped to an eye-popping 17 billion after the 46th drawing passe...

12/23/2025

A coalition of 21 attorneys general from Oregon and Democratic-led states sued the Consume...

12/23/2025

Betty Reid Soskin who rose to national fame as the oldest National Park Service ranger and...

12/23/2025

Ruch OREGON - The forests of southwest Oregon are facing significant stress due to a combi...

12/23/2025